Flash Note

![[Main Media] [Fund Focus] [CP Campaign] [Main Media] [Fund Focus] [CP Campaign]](https://carmignac.imgix.net/uploads/article/0001/12/962710ad24598a4639b310c980e6eb66eb369433.png?auto=format%2Ccompress)

Carmignac Patrimoine: Letter from the Fund Managers

Q1 2021

Market environment

Markets started out the year boosted by hopes of reopening economies, supported by vaccine roll-outs, highly accommodative Central bank policies as well as massive fiscal support. This backdrop led to a value-led equity market rally and to the worst quarterly return in the US Treasury market since 1980, down -4.6%. In this context, Carmignac Patrimoine1 returned 1.18% in the first quarter 2021, while its reference indicator2 rose by 3.47%.

Equity, fixed-income and forex markets showed major geographic dispersion as differing vaccination timetables suggested that economic recovery would be stronger in some countries than in others.

Portfolio allocation

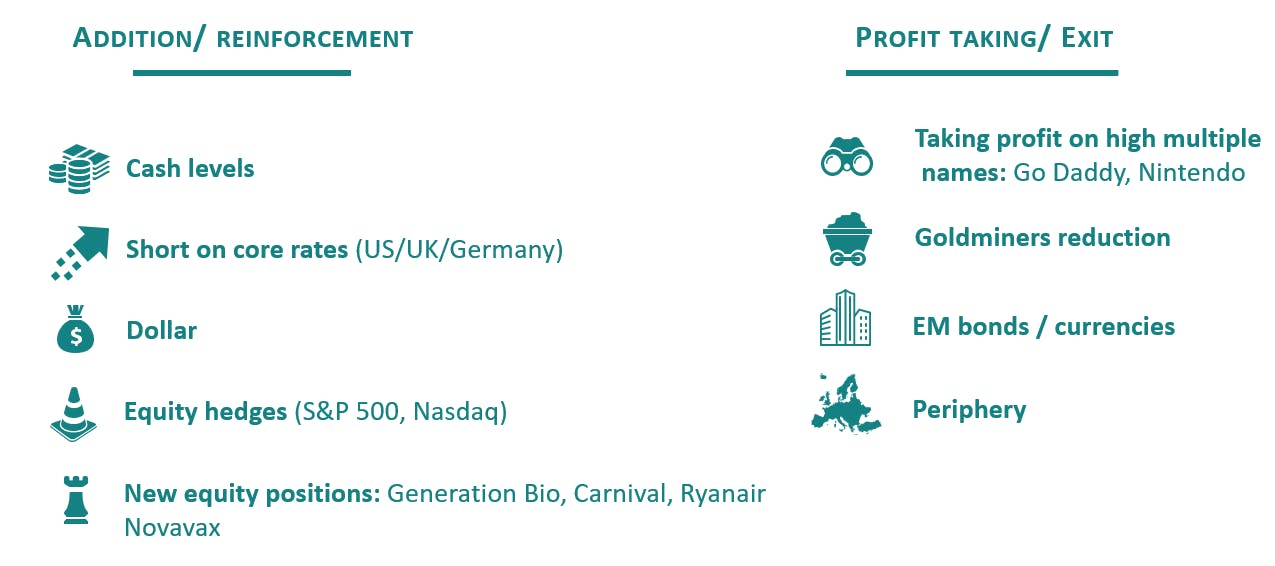

Our interest-rate risk management, through short positions in US and German bonds has helped to generate positive return while its bond benchmark lost -0.95%. Despite this rise in interest rate, credit market has proved resilient, supporting our selective corporate bond picking. However, the equity rotation we experienced hurt the relative performance of the Fund despite some alpha generation in sectors where we have built an expertise, like healthcare, consumption and communication services. In addition, our Chinese growth companies have suffered from increased volatility in the region, due to profit-taking and the rise of uncertainties. Finally, our cautious stance on the dollar has penalized the relative performance of the Fund.

In light of the current US economic policy, the cyclical rise in inflation could be higher and longer than market expectations– genuine change of inflation regime seems possible – provided monetary and fiscal policy are coordinated well enough to keep them from cancelling each other out. This could lead to further upward movement in rates, probably driven more by an increase in real rates with a target close to 0 at the end of the year. We are accordingly sticking with our cautious stance, with bond portfolio duration remaining low or negative.

The portfolios of Carmignac funds may change without previous notice.

Source: Carmignac, 25/03/2021

The differential in Gross Domestic Product (GDP) growth rates between Europe and the United States is likely to narrow as vaccination campaigns and the economic recovery gain traction. Eurozone interest rates have joined in the upward trend, albeit to a lesser degree owing to the region’s slower economic recovery and the continued vigorous action by the European Central Bank (ECB). But we now see a clear catch-up opportunity and thus expect European yields to rise in the second quarter leading us to reduce our exposure to non-core European countries. On the contrary, this lag of Europe has created attractive opportunities on the equity front for a selected number of “reopening trades” in tourism. The airport operator Aena and the low-cost airline company Ryanair are examples of positions that we have built over the last months.

The Euro weakened against the US dollar over the quarter. However, as vaccination campaigns gather momentum and set the stage for an economic recovery, we could see the greenback lose ground against the single currency.

This dynamic would help Emerging markets where we remain very selective both on the equity and fixed income side. China remains our biggest conviction, with bonds offering a yield of close to 3% and a near-zero inflation rate. On equity, we remained positioned on secular growth names mostly in technology, consumption and healthcare. With the Chinese economy further ahead in the cyclical recovery than the rest of the world, we may be seeing a slowdown in the months to come that will work to the advantage of the names offering predictable earnings growth that we hold in our portfolio.

Outlook

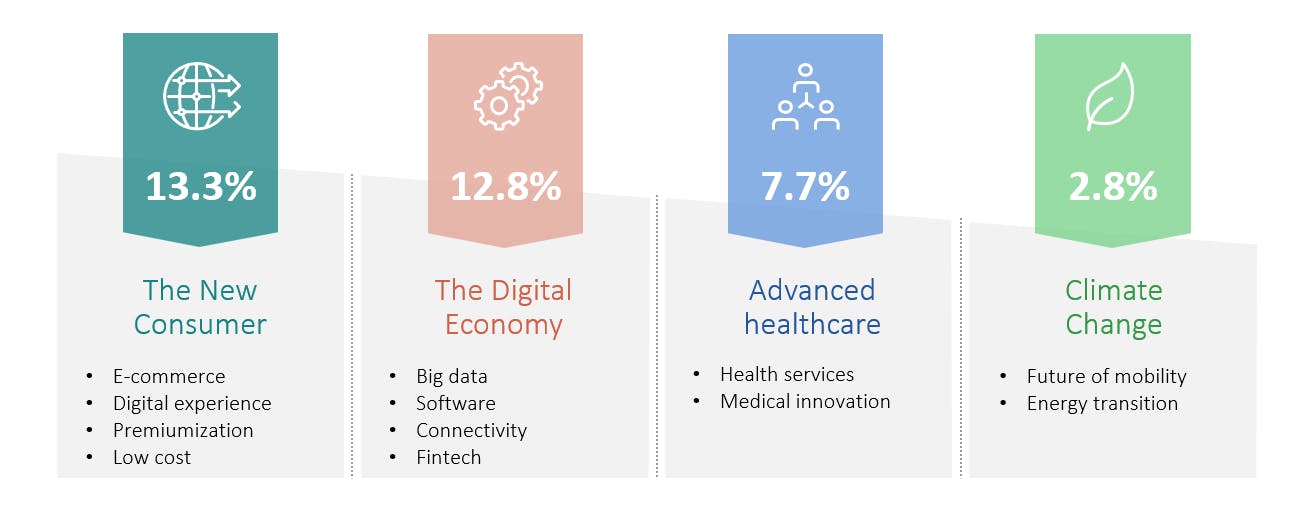

While this environment remains challenging for fixed income, we find the equity risk premium and upside from owning secular growth franchises more appealing and key to our performance potential in 2021. Our research focuses on companies that will be able to keep profit margins up, particularly if inflation rises; and stand their ground even if GDP growth falls short of expectations – a scenario that can’t be ruled out at this stage. Overall, we maintain a liquid and solid equity portfolio of strong convictions, diversified in terms of geography, sectors and themes. Indeed, our main thematics revolve around:

Source: Carmignac, 31/03/2021. Others: 5.3%. Portfolio composition can change over time and without prior notice.

Overall, the unusual nature of this cyclical shock and subsequent policy response has created the possibility of a variety of disparate outcomes, in particular relating to the deflationary output gap and explosion higher in Debt to GDP versus the inflationary co-ordinated policy response to support asset prices and materially increase the supply of money reaching the real economy.

Although the political noise might have recently died down, the re-opening path will be bumpy. Vaccine distribution and efficacy in light of new strains will remain challenging, and if both prove easy, we will be that much closer to less policy and therefore market support. We will stay open-minded and flexible. We will try to maintain a balanced portfolio construction across asset classes, risk factors, and time horizons.

Carmignac Patrimoine

Looking for best asset allocation in all market conditions

- Multiple asset classes across the globe to capture opportunities in different market configurations

- Risk management at the heart of the mandate

- Dynamic and flexible management to quickly adapt to market movements

Carmignac Patrimoine A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Patrimoine A EUR Acc | +8.81 % | +0.72 % | +3.88 % | +0.09 % | -11.29 % | +10.55 % | +12.40 % | -0.88 % | -9.38 % | +2.20 % | +7.06 % |

| Reference Indicator | +15.97 % | +8.35 % | +8.05 % | +1.47 % | -0.07 % | +18.18 % | +5.18 % | +13.34 % | -10.26 % | +7.73 % | +5.28 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Patrimoine A EUR Acc | -1.70 % | +2.69 % | +1.93 % |

| Reference Indicator | +2.59 % | +5.21 % | +6.39 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,51% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 0,63% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |

1 Carmignac Patrimoine A EUR Acc (ISIN: FR0010135103).

Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations. The portfolios of Carmignac funds may change without previous notice. Performances are net of fees (excluding possible entrance fees charged by the distributor). Annualized performance as of 31/03/2021.

2 Reference Indicator: 50% MSCI ACW NR (USD) (Reinvested net dividends) + 50% ICE BofA Global Government Index (USD). Quarterly rebalanced.

Carmignac Patrimoine E EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

The Fund presents a risk of loss of capital.