2023: Our active stewardship illustrated

As a long-term investor, we engage in regular dialogue with the companies in which we invest to encourage them to improve their practices for taking environmental, social and governance (ESG) criteria into account. Find out how our active approach to stewardship was borne out in 2023:

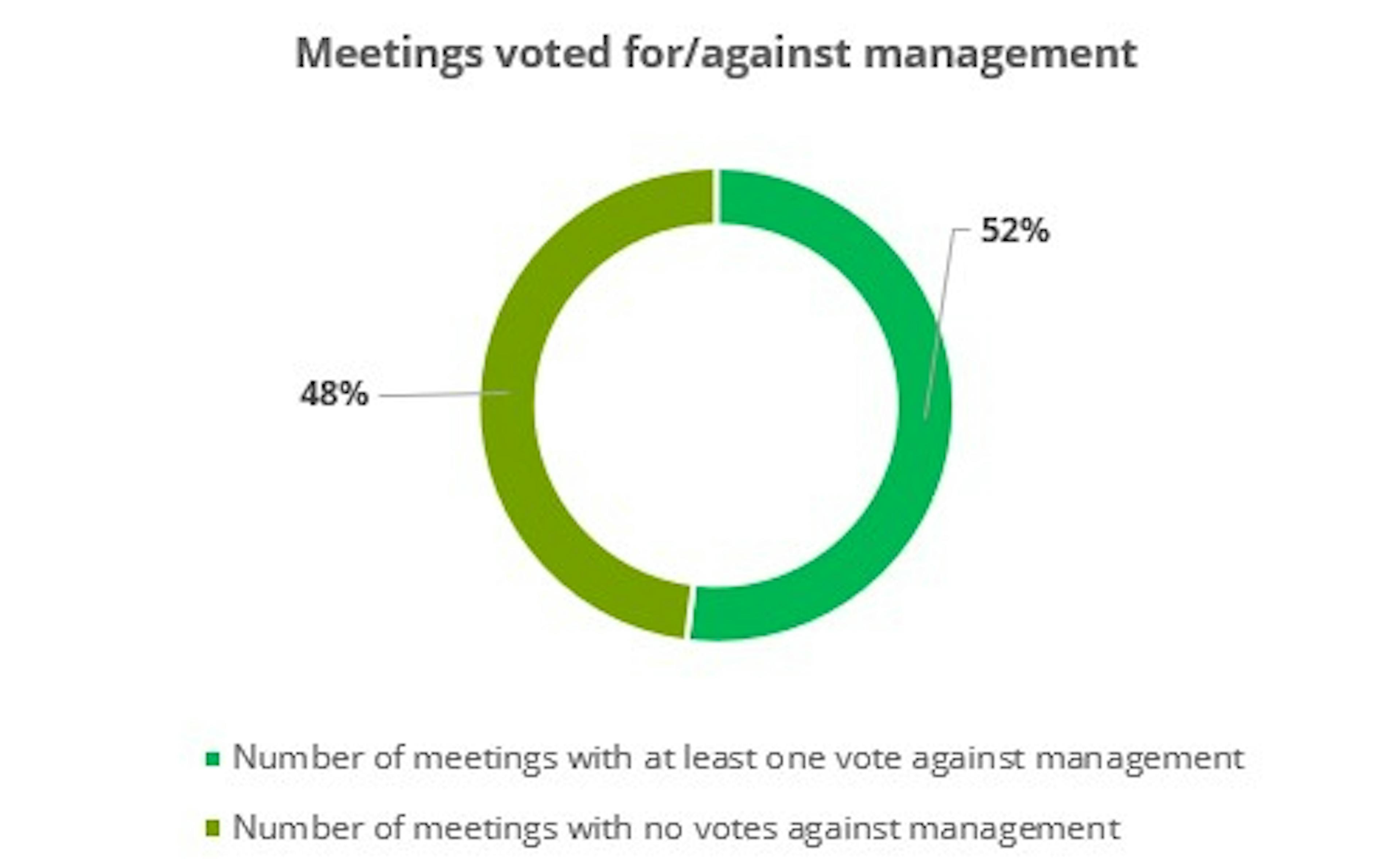

*This data refers to the number of meetings where Carmignac took a vote position against the recommendation of the board. In practice, this refers to votes cast against management-led resolutions and, in most cases, votes cast for shareholder-led resolutions (unless the shareholder-led resolution is supported by management).

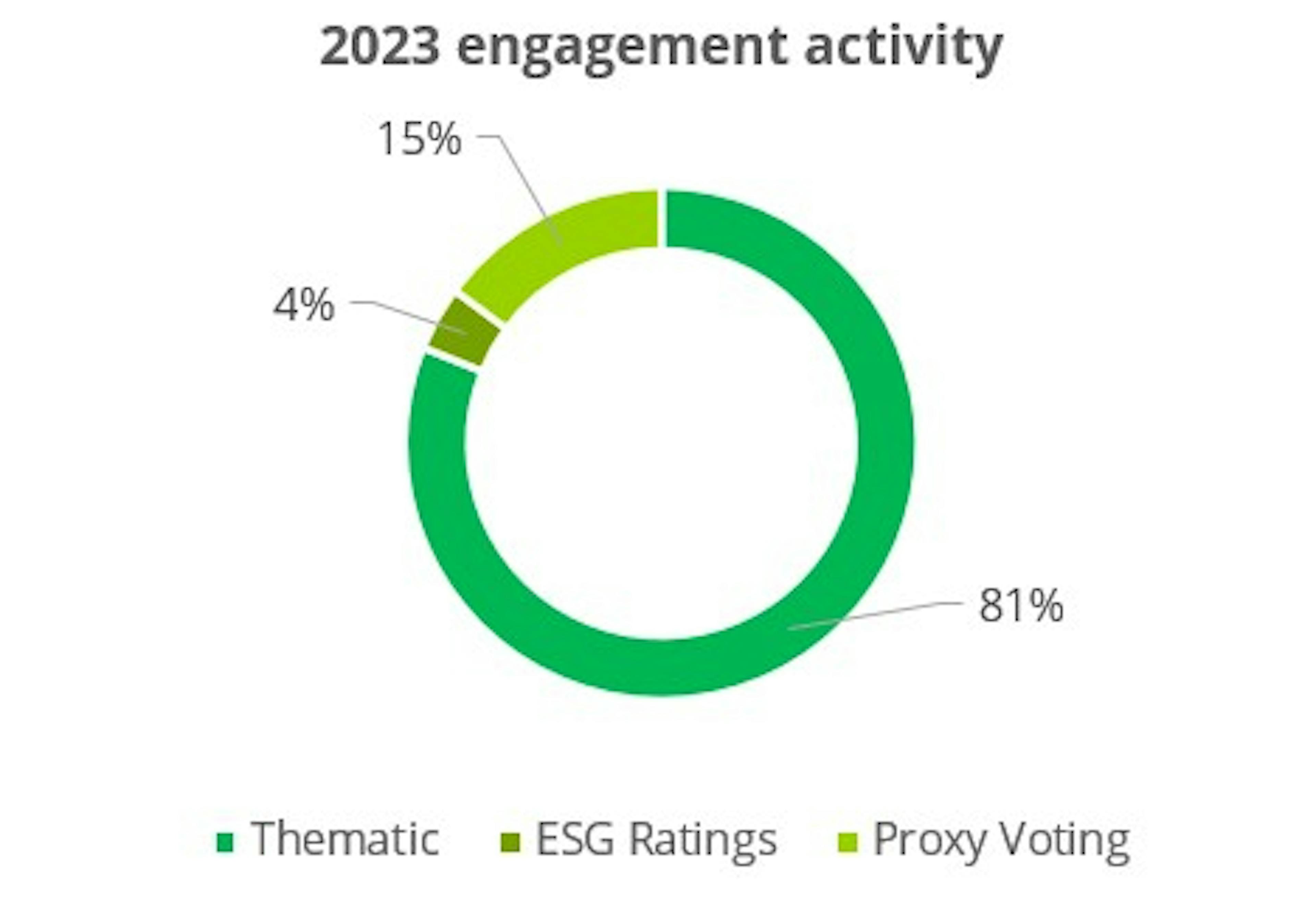

Carmignac is committed to aligning its dialogue strategy with five types of engagement: engagement on ESG ratings, thematic engagement, impact engagement, engagement on controversial behaviour, and engagement on proxy voting decisions.

Find out how we specifically engaged with two investee companies during 2023.

Anta Sports

Sector: Apparel

Region: China

Carmignac is an equity investor in the company1.

Eni Spa

Sector: Energy

Region: Europe

ENI is a fixed income holding in our funds2.

2As of 29th December 2023: Carmignac Credit 2025, Carmignac Credit 2027, Carmignac Credit 2029 Carmignac Alts ICAV Carmignac Credit Opportunities, Carmignac Portfolio Flexible Bond, Carmignac Portfolio Credit, Carmignac Portfolio Evolution, Carmignac Portfolio Flexible Allocation 2024, Carmignac Portfolio Global Bond, Carmignac Patrimoine, Carmignac Profil Réactif 100, Carmignac Profil Réactif 50, Carmignac Profil Réactif 75, Carmignac Sécurité, Carmignac Portfolio Patrimoine, Carmignac Portfolio Sécurité, FP Carmignac Unconstrained Global Bond.

To find out more on our responsible investment philosophy, please visit our Sustainable Investment section:

Sustainable InvestmentRelated articles

Carmignac’s Article 9 funds: a sustainable investment?

Electronic waste recycling – a global challenge

Marketing Communication. This document is intended for professional clients.

The decision to invest in the promoted fund should take into account all its characteristics or objectives as described in its prospectus.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. The information contained in this material may be partial information and may be modified without prior notice.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice.

Copyright: The data published in this presentation are the exclusive property of their owners, as mentioned on each page.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, succursale de Nyon/Suisse, Route de Signy 35, 1260 Nyon.

UK: This document was prepared by Carmignac Gestion and/or Carmignac Gestion Luxembourg and is being distributed in the UK by Carmignac Gestion Luxembourg UK Branch (Registered in England and Wales with number FC031103, CSSF agreement of 10/06/2013).

CARMIGNAC GESTION 24, place Vendôme - F-75001 Paris - Tél : (+33) 01 42 86 53 35 Investment management company approved by the AMF Public limited company with share capital of € 13,500,000 - RCS Paris B 349 501 676.

CARMIGNAC GESTION Luxembourg - City Link - 7, rue de la Chapelle - L-1325 Luxembourg - Tel : (+352) 46 70 60 1 Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF.

Public limited company with share capital of € 23,000,000 - RC Luxembourg B 67 549