Flash Note

Investor of conviction, investor of action: takeaways from the 2022 voting season

The end of an active voting season1 is an opportunity for Carmignac to comment on the highlights of the season and report on how we voted at the shareholder meetings of our investee companies.

During this 2022 voting season

-

97%Carmignac voted 97% of votable meetings

-

59%Carmignac cast at least one vote against management at 59% of the meetings we voted

-

12%votes were cast against the management of the companies we invest in, a small increase versus 10% over the same period in 2021

Exercising our voice by voting against management … what next?

We use our vote to signal concerns to management but this often does not stop here and we can seek to complement the vote by an engagement to provide detailed feedback to the company on the concerns that triggered a decision to vote against.

This was especially the case during this voting season regarding management ‘say on climate’ resolutions, where the management of our investee companies asks shareholders to approve their climate policy or report.

Active ownership on the rise

Overall, the 2022 voting season saw a strong increase in active ownership by investors through the filing of a significant number of shareholder resolutions6 at our investees’ AGMs.

This was particularly the case in the US market where the Securities and Exchange Commission (SEC) implemented new rules7 which make it harder for companies to block the filing of shareholder proposals.

In the European market, we noted that some attempts to file shareholder resolutions on the agenda of the AGM of some of our investee companies were blocked.

-

The TotalEnergies example (France)

The board of TotalEnergies took the decision not to include a shareholder proposal filed by 11 shareholders on the topic of its climate strategy as it deemed the resolution “encroaches on the public policy competence of the board of directors to define the Company’s strategy”8.

The group of shareholders referred the issue to the French financial market authority (Autorité des Marchés Financiers or AMF) who declared itself incompetent on the matter. The President of the AMF however separately expressed his wish to see the legislator intervene on the topic.

We see this as a first push by shareholders towards improving shareholder democracy in this market.

This trend towards an increase in shareholder resolutions is reflected in our voting statistics. Carmignac voted 165 resolutions filed by shareholders in the first half of 2022 globally, an increase from 104 over the same period last year. 48% of these shareholder resolutions we voted were filed at US investee companies.

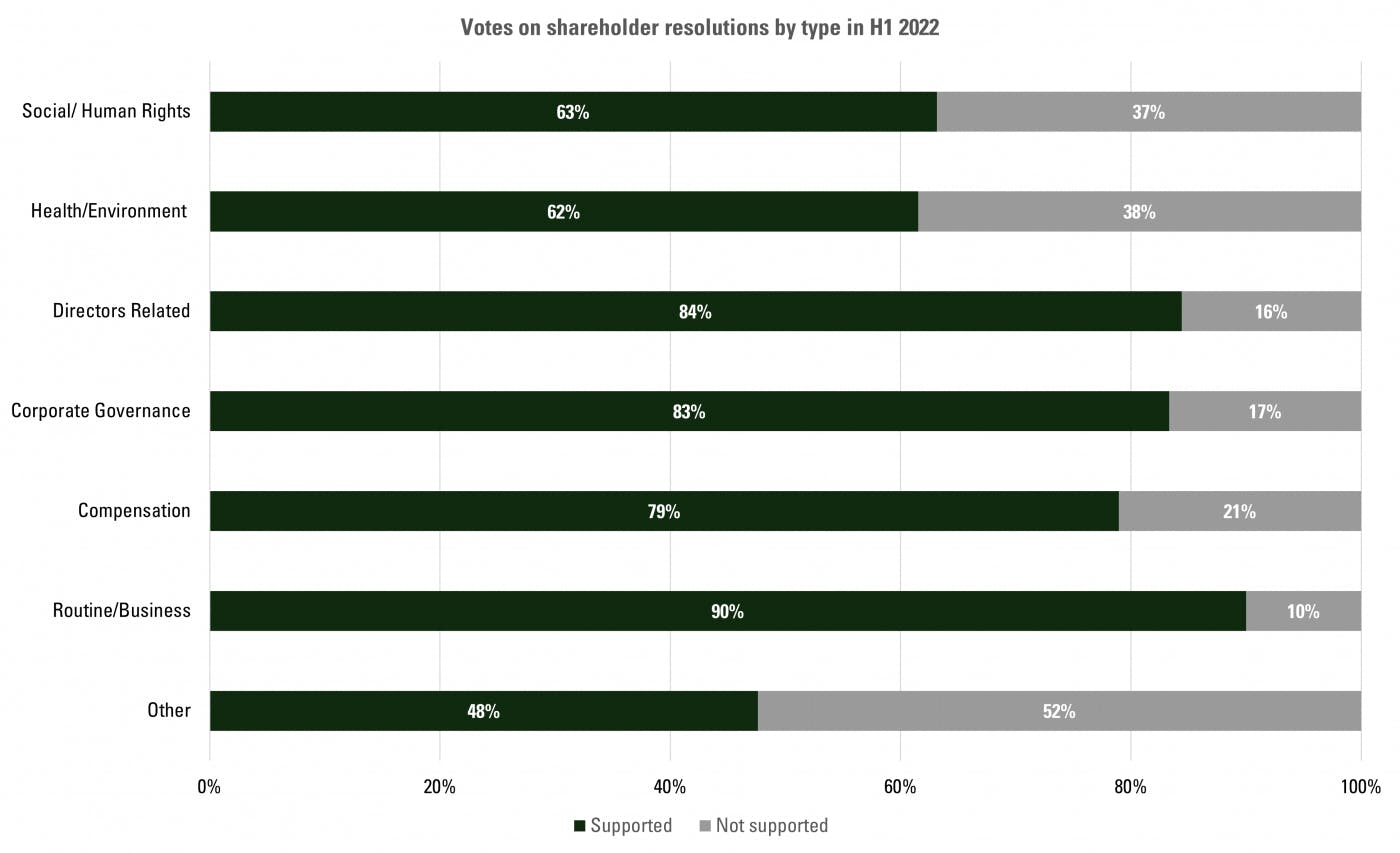

We supported 75% of all shareholder resolutions submitted to our vote, a small increase compared with the first half of 2021 (71%).

Our in-person engagement with the company a month before the AGM, helped us understand the steps the company is taking to improve its approach to social and environmental issues and contributed to inform our voting decision. However, among our expectations, we provided feedback to the company that they need to improve the overall transparency on the various environmental and social initiatives they are taking to improve perception issues. Our support for 7 shareholder resolutions is very much linked to this ongoing engagement.

For example, we decided to support resolution 16 which requested that the board of directors of the company commission and independent audit and report of the working conditions and treatment that the company’s warehouse workers face. We believe that this topic currently poses reputational risks as well as operational risks from a more limited labour pool, high workforce turnover and high cost of labour force.

Whilst our engagement with the company helped us get a better insight into the actions they are taking to improve conditions, we think a third party audit would increase transparency around the topic and help stakeholders as well as the company more accurately assess the issue.

Whilst none of these resolutions obtained sufficient shareholder approval to pass, we continue to monitor the company’s ESG practices and engage with them.

-

Carmignac’s approach

What we are trying to evidence in this piece is that whilst Carmignac has an active and conviction-based approach to investment, this does not prevent us from voting against the management of a company when we think it is appropriate to do so.

We use our voting rights as an opportunity to encourage our investee companies to make improvements aligned with ESG best practices which are in the long-term interests of the company, their stakeholders and ultimately our clients.

For more information regarding our approach to voting, please consult our Voting Policy.

1The general meetings of our investee companies tend to be concentrated in the period between March to June, this is what we refer to as the voting season

2Resolution 13 - Approve Climate Progress Report

3https://www.glencore.com/media-and-insights/news/results-of-2022-agm

4Resolution 16 - Approve Company's Sustainability and Climate Transition Plan

5https://totalenergies.com/sites/g/files/nytnzq121/files/documents/2022-05/AG2022_Resultats-des-votes-par-resolution_EN.pdf

6For instance, please refer to Georgeson’s 2022 early proxy season review which describes a ‘record number of shareholder proposal submissions’: https://www.georgeson.com/us/insights/2022-early-proxy-season-review/

7For more details on this, please refer to the speech given by Renee Jones, Director of the Corporate Finance Division at the SEC https://www.sec.gov/news/speech/jones-cii-2022-03-08

8https://totalenergies.com/media/news/press-releases/board-directors-totalenergies-promoting-dialogue-its-shareholders

![[ISR pages] Picto E [ISR pages] Picto E](https://carmignac.imgix.net/uploads/logo/0001/13/16f64d9f86fb6d130b5cf29ceabe3f5987fa91b6.png?auto=format%2Ccompress)

![[ISR pages] Picto G [ISR pages] Picto G](https://carmignac.imgix.net/uploads/logo/0001/13/7e0cb22a8c0e0f44240f6ac92c4a370d6dc4ba62.png?auto=format%2Ccompress)