Funds in Focus

![[Background image] [CI] Blue sky and buildings [Background image] [CI] Blue sky and buildings](https://carmignac.imgix.net/uploads/article/0001/05/CI_WEB.jpg?auto=format%2Ccompress)

Carmignac Investissement: the Fund Manager’s thought

Carmignac Investissement had a strong third quarter, generating 7.2% of performance while the reference indicator gained 3.6%, resulting in relative outperformance of 3.7%. This brings the fund’s 2020 performance through the end of the third quarter to 15.8%, an outperformance of 18.7% versus the reference indicator.

The third quarter marked the ongoing recovery of the global economy from the COVID related low point in March. In the U.S., income levels remained largely consistent with pre-COVID levels due to fiscal stimulus and rebounding employment.

Consumer balance sheets are robust, with personal savings up $1.7 Trillion since February and consumer net worth at an all-time high.

U.S. Covid case counts stabilized in August and have only risen modestly as schools reopened and indoor dining resumed. While European COVID infection trends have been more concerning, it is important to note that the mortality rate in both the US and Europe has fallen as therapeutics have improved, making it unlikely that economies return to the state of lockdown experienced at the end of the first quarter. While we envision a steady improvement in global economic activity as fiscal and monetary policies remain supportive – the “check mark” shaped recovery mentioned in our last letter – it is clear that a widely distributed vaccine is required for activity to recover to pre-COVID levels. Our expectations are for one or more vaccines to be approved for limited use in late Q4 with wide U.S./European distribution in late Q1 or early Q2 of 2021.

In the interim we believe that fiscal support will remain in place to “plug the gap”. While U.S. fiscal policies have become highly political, we see the election as a clearing event that will ensure the fiscal support needed to reach post-vaccine normalization. The election is additionally highly relevant for forward tax rate, fiscal and regulatory policy and we envision many stock selection opportunities to present themselves once we have resolution.

With this backdrop in mind our portfolio construction is balanced between core positioning in secular growth stocks, which are not directly affected by the economic backdrop and benefit from the low interest regime, and some opportunistic exposure to companies levered to a normalization of behaviour post-vaccine, mainly in the travel sector.

-

Our focus within secular growth is mainly in the Technology, Healthcare, Consumer and Fintech sectors.

-

As noted in our last letter, these core positions proved extremely resilient to a global economic stoppage – consumers and enterprises simply did not stop adopting the powerful trends of e-commerce, digital payments, cloud-based software, and streamed entertainment.

Moreover, as the world adjusted to quarantine and “Work from Home/Stay at Home” dynamics, many of these adoption curves were vastly steepened, pulling forward penetration rates and profits into the near term. Our view is that these penetration rates will be largely maintained as global economies re-open and continue to higher levels over time. Of course, we are always sensitive to the risk/reward of our holdings, and we are very willing to take profits when we believe returns be less favourable.

On a sector basis, the Fund’s portfolio saw gains over the third quarter mainly from the Consumer Discretionary, Technology, Communications Services, and Healthcare sectors. Third quarter returns in Consumer Discretionary were again dominated by significant e-commerce positions in Amazon and JD.com, which were notable beneficiaries of the COVID crisis, as well as from a new position in Chinese electric vehicle manufacturer NIO. Technology returns benefited from strong software performance by Salesforce.com and Snowflake, a data analytics company that we had followed for years as a private company, which positioned us well to receive a significant allocation when it went public in September. Our performance in Communications Services was led by positions in Facebook, Nintendo and Twitter, and our Healthcare performance was once again led by Chinese positions: Zhifei Biologic and Wuxi Biologics. Sector losses were led by relative weakness in U.S. healthcare positions which underperformed due to election uncertainty.

As we finish 2020 and look towards 2021, we believe that we are likely to remain in a low growth environment as we recover from COVID headwinds, and thus that secular growth is preferable. We continue to search for investment ideas where we feel we can formulate a differentiated view from the consensus.

The portfolio composition may change

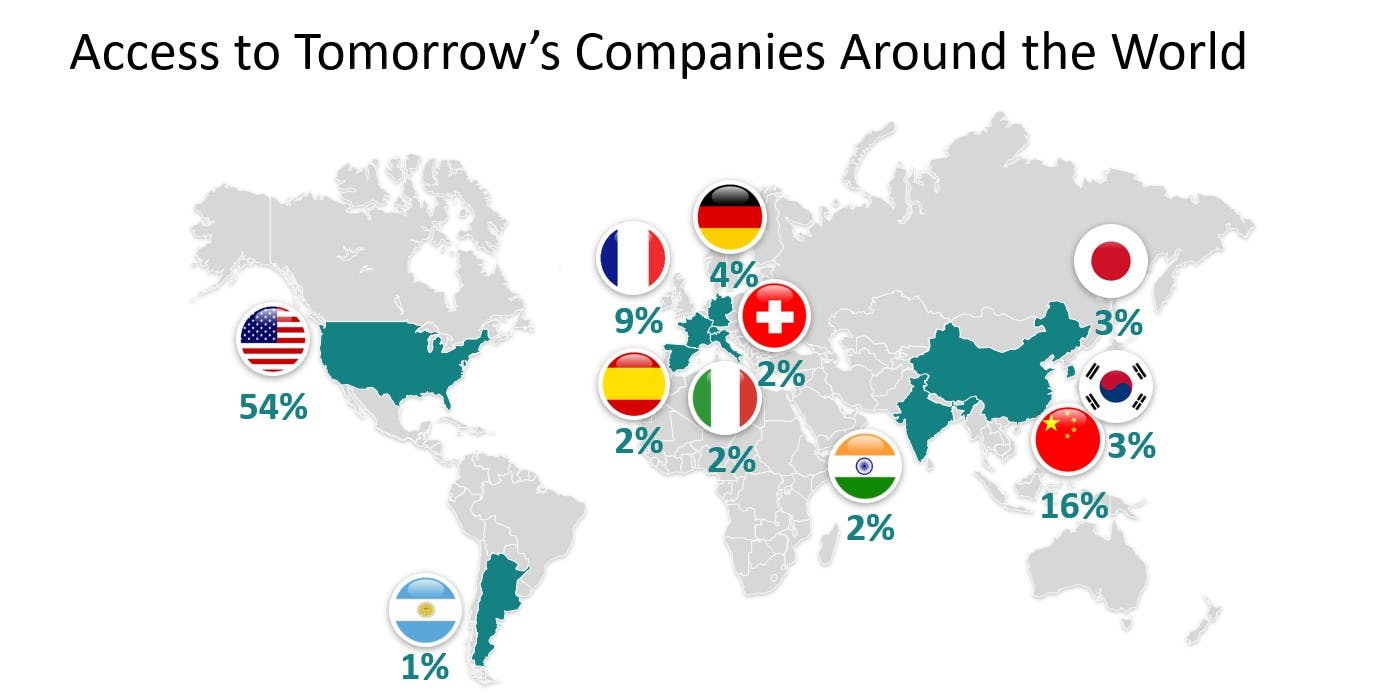

Others: 1%

The geographic location where exposure remains elevated for the fund is China, where exposure rose again to 16%. Our investments in China remain focused on the same themes we have been expressing globally across the portfolio, namely Technology, Consumer Internet, and Healthcare. Two Chinese Electric Vehicle manufacturers, NIO and XiaoPeng, were added to the portfolio this quarter. We note that our Chinese exposure is focused on the domestic market, not companies dependent on U.S. technology or export markets.

Carmignac Investissement A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Investissement A EUR Acc | +10.39 % | +1.29 % | +2.13 % | +4.76 % | -14.17 % | +24.75 % | +33.65 % | +3.97 % | -18.33 % | +18.92 % | +21.41 % |

| Reference Indicator | +18.61 % | +8.76 % | +11.09 % | +8.89 % | -4.85 % | +28.93 % | +6.65 % | +27.54 % | -13.01 % | +18.06 % | +14.72 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Investissement A EUR Acc | +3.46 % | +11.61 % | +7.69 % |

| Reference Indicator | +9.06 % | +12.09 % | +11.12 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,50% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 1,09% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |

Reference indicator: MSCI ACWI (USD) (Reinvested net dividends). Annualized performance as of 30/09/2020. Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged. Performances are net of fees (excluding possible entrance fees charged by the distributor). The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager. © 2020 Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Carmignac Investissement E EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.