Quarterly Report

Carmignac P. EM Debt: Letter from the Fund Manager

-

+1.97%Carmignac P. EM Debt’s performance

in the 2nd quarter of 2023 for the FW EUR Share class

-

+2.08%Reference indicator¹’s performance

in the 2nd quarter of 2023 for JP Morgan GBI – Emerging Markets Global Diversified Composite Unhedged EUR Index

-

+6.37%3-year annualized performance

versus -0.46% for the reference indicator over the period

Carmignac P. EM Debt gained +1.97% in the second quarter of 2023, while its reference indicator1 was up +2.08%.

Market environment

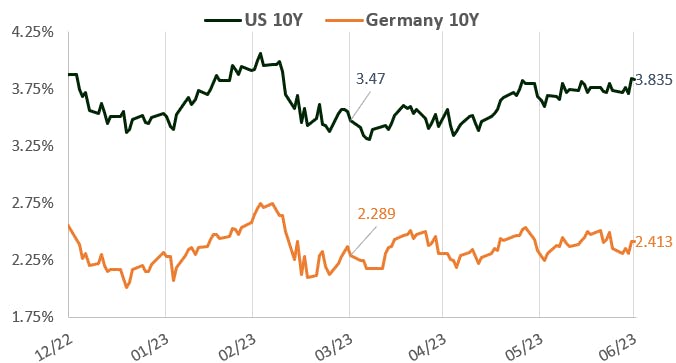

The second quarter has been characterized by strong bullish sentiment in risky markets as well as higher global rates. The 10-year Treasury went from around 3.5% to over 3.8%, while the MSCI World added 3.7% of performance.

Germany and US 10-year rates evolution

Sources: Carmignac, Bloomberg, 30/06/2023

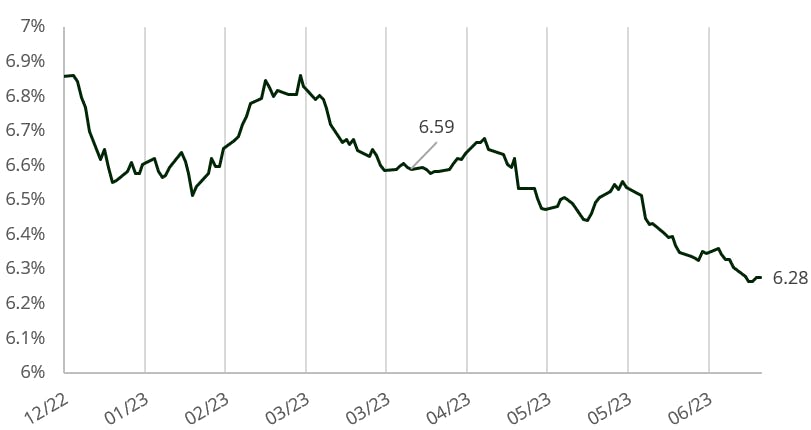

In terms of local rates, we have continued to see a slowdown in the emerging market (EM) inflation (as well as developed markets (DM) inflation). In this context the local bonds performed particularly well with the reference indicator GBI-EM index’s yield dropping by 31 basis points over the quarter. We also saw the first rate cut in the EM universe this quarter with Hungary cutting twice by 100bps each time its overnight rate. We think that a number of countries are likely to follow in the next 2 quarters, such as Brazil, Chile, and Czechia.

GBI-EM Index (Local sovereign debt index) - Yield Evolution

Sources: Carmignac, Bloomberg, 30/06/2023

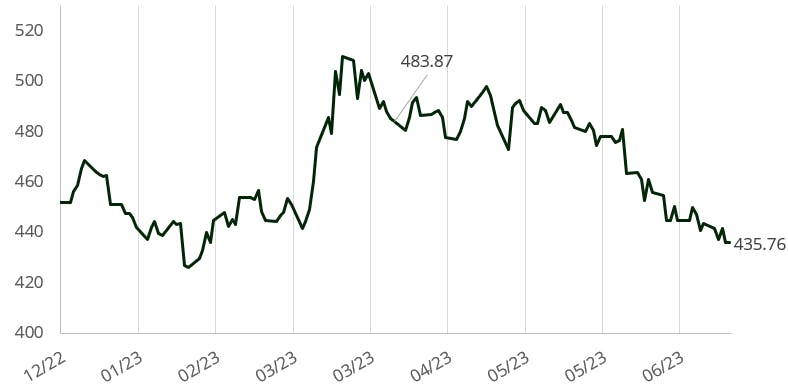

Furthermore FX, despite the lower rates in EM retained a strong real carry and continued to attract investors with the exception of Asia suffering from its negative carry. We also saw that the political noise in Israel and South Africa (as well as power issues) significantly affected these currencies. For the sovereign credit we have seen a good performance with the EMBIGD1 index as a whole, but the EMBIGD HY2 outperformed with a compression of spreads by 60bps over the period.

J.P Morgan EMBIG diversified hedged EURO index (External sovereign debt index) - Spread Evolution

Sources: Carmignac, Bloomberg, 30/06/2023

What have we done in this context?

In this context we have benefitted from the Local Rates rally in the CZK, HUF, MXN and BRL curves. Following the rally, we started to reduce as large interest rate cuts are starting to get priced, and the usual correlation between DM rates and these Local Curves seems to have broken during this quarter. In particular we have reduced the CZK, BRL and MXN rates. In the FX space we continue to enjoy the carry and performance of EM FX currencies. Like in the previous quarter we have been long HUF, CZK, BRL, and MXN. During the quarter we reduced our HUF after its strong rally and as the central bank started to cut rates at a steep pace. We also used the weakness in ILS and ZAR to enter into tactical positions. For sovereign credit, following the strong performance of the high yield (HY) we took the chance to reduce the exposure of the fund while keeping our more investment grade (IG) names. Another important event was our purchase of Turkey credit default swap (CDS) to protect the book but which paid off as Erdogan won the elections where we also reduced the protection.

Outlook for the next months

Looking forward to it, we still expect a recession to hit the global economy: high rates are eating at demand and effect we are already largely seeing it in the EM world. Furthermore, China which last quarter was seen as launching a potentially large stimulus to boost growth, is showing that it is unwilling to repeat the policies of the past thus removing a possible source of global growth. This view of recession and high rates is reflected in our portfolio construction, namely a large reduction of risk assets. We also remain focused on duration with the view that a recession would force DM central banks to cut rates and thus enable further cuts in the EM world. This leaves us with EM FX which offer carry while having a central bank ready to defend the currency such as the CZK and the INR, as well as tactical/opportunist investments. In Local Rates we are ready to re-engage in the hikers notably in the BRL or HUF once the FED or ECB have paused and EM central banks can accelerate their cutting cycles. In Credit we remain cautious with protection against our HY names and will keep our positioning light and focused on the IG space.

1 J.P Morgan EMBIG diversified hedged EURO index

2 J.P Morgan EMBIG HY diversified hedged EURO index

Carmignac Portfolio EM Debt FW EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

CREDIT: Credit risk is the risk that the issuer may default.

The Fund presents a risk of loss of capital.

Carmignac Portfolio EM Debt FW EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Portfolio EM Debt FW EUR Acc | - | - | - | +1.10 % | -9.97 % | +28.88 % | +10.54 % | +3.93 % | -9.05 % | +15.26 % | +0.37 % |

| Reference Indicator | - | - | - | +0.42 % | -1.48 % | +15.56 % | -5.79 % | -1.82 % | -5.90 % | +8.89 % | +0.38 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Portfolio EM Debt FW EUR Acc | +1.23 % | +6.93 % | - |

| Reference Indicator | +0.43 % | +0.15 % | - |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | We do not charge an entry fee. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,05% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | There is no performance fee for this product. |

| Transaction Cost : | 0,57% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |