Quarterly Report

Carmignac Sécurité : Letter from the Fund Manager

In the third quarter of 2021, Carmignac Sécurité withstood the headwinds buffeting the fixed-income market, returning +0.14% compared to a negative performance of -0.08% for its reference indicator¹ (ICE BofA ML 1-3 years Euro All Government Index (EUR)). A flexible investment approach and cautious portfolio construction enabled us to take rising yields in our stride.

-

+0.14%Carmignac Sécurité’s performance

in the 3rd quarter of 2021 for the A EUR Share class.

-

-0.08%Reference indicator’s performance

in the 3rd quarter of 2021 for ICE BofA ML 1-3 years Euro All Government Index (EUR).

-

+0.69%Performance of the Fund Year to date

versus -0.44% for the reference indicator.

Quarterly Performance Review

In the third quarter, the “restart the economy” trend gained further traction in the developed countries as they got better control over the pandemic. But it hasn’t been entirely a smooth ride. Savings rates are abnormally high for an economy pulling out of a slump (a by-product of the unprecedented income support programmes instituted by governments), with the result that consumer spending has surged impressively. At the same time, more and more supply-chain bottlenecks have emerged, running the gamut from products like semiconductors (where shortages are holding back new car production) to labour supply, another unusual development as economies begin to recover.

These signs of dysfunction have been pushing prices so strongly upwards that developed-world inflation is back to levels that had become little more than a distant memory. This in turn has compelled central banks – whose primary role is to achieve price stability – to maintain their highly dovish monetary policies even though Gross Domestic Product (GDP) growth and inflation would appear to call rather for policy tightening. Their justification for doing so is that the current bout of inflation will be short-lived. The consumer spending binge will soon subside, they claim, supply chains will get back to normal and the base effects caused by lockdowns will eventually be over, leading to lower inflation within a year. The lessons from 2013 and 2018 – when asset purchases were scaled back and interest rates hiked too soon or too abruptly for the broader economy to be able to handle the shift – have made central bankers extremely cautious about withdrawing their current easy-money policies. Nominal yields barely budged over the third quarter (with 10-year paper trading at –0.20% in Germany and 0.83% in Italy), but higher inflation expectations drove real yields down to record lows (sending 10-year Bund yields close to –2%).2

The lessons from 2013 and 2018 have made central bankers extremely cautious about withdrawing their current easy-money policies

Apparently unruffled by the turmoil in China’s property market and the potentially adverse impact of rising commodity prices, credit spreads likewise showed little change during the period. Investment-grade credit ended the third quarter with an average yield of 0.34%, meaning roughly on par with where it stood three months earlier. Subordinated bank bonds once again brought us positive returns this past quarter. Spreads narrowed slightly, meaning we were able to record capital gains in addition to the substantial returns from our carry strategy.

How is the fund positioned?

We made no major changes to our credit exposure during the period. The Fund has a high allocation to corporate bonds with maturities of under 7 years (a segment with sufficient carry and only limited duration risk). Nor did we reshuffle our holdings of Collateralised Loan Obligations (CLOs) after the purchases we made in the second quarter.

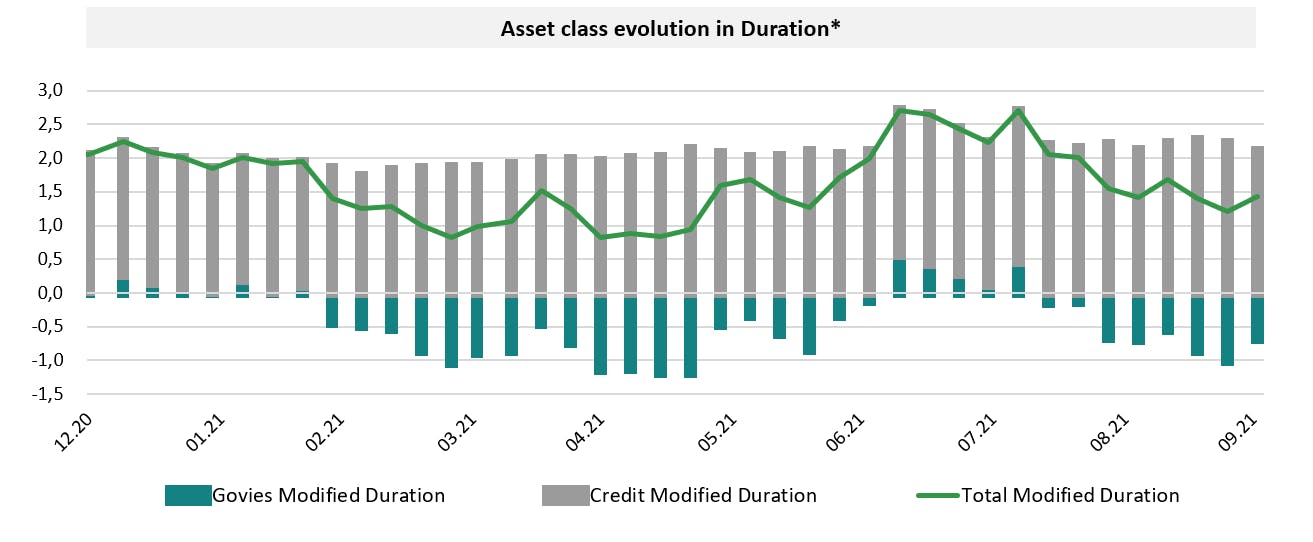

While the third quarter saw very little change in our corporate bond portfolio, we did take major steps to manage our modified duration. We started out by raising it in the first half of July from 1.6 to nearly 2.7 years. We did so by dialling down our sell positions on UK debt and increasing our holdings of “semi-core” eurozone government bonds. Next, we changed tack and reduced the portfolio’s duration by gradually exiting our positions in Italian government paper. Discussions on the planned end to the ECB’s Pandemic Emergency Purchase Programme (PEPP), which is likely to occur in March 2022, could weaken the eurozone’s more indebted members, as they are currently helped more by the central bank’s regular bond purchases than by negative real interest rates. On similar grounds, we reduced our exposure to Romanian debt in early August. This shift to lower duration by offloading Italian and subsequently “core” government bonds (US, UK and French) continued until the close of the quarter. By end-September, our exposure to Italian debt was close to 0 and the portfolio’s overall modified duration was back to 1.3, which was slightly lower than at end-June.

Source : Carmignac, 30/09/2021

*Include derivatives

What is our outlook for the coming months?

It is still far from clear how central banks will respond to the current inflationary pressure. Though they seem convinced that the problem will be temporary and underscore the threat to economic recovery created by supply shortages, any sign of more persistent inflation could hasten the break with the current super-cycle of loose central-bank policy. And as rising uncertainty and cyclical transitions tend to cause volatility in financial markets, managing Carmignac Sécurité will still require considerable flexibility in the months to come. We have accordingly boosted our cash holdings to nearly 9% of the portfolio. We have also gained exposure to the eurozone inflation theme by buying 10-year inflation-linked bonds and swaps on the 5-year segment. This affords us inexpensive hedges in the event of a spike in inflation that would prove harmful to our credit portfolio. Lastly, we have credit protection via a basket of CDSs that account for 5% of the Fund’s assets.

¹Reference indicator: ICE BofA 1-3 Year All Euro Government Index (coupons reinvested).

²Source: Carmignac, Bloomberg as of 30/09/2021. Performance of the A EUR acc share class.

Until 31 December 2020, the reference indicator was the Euro MTS 1-3 years. Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Carmignac Sécurité AW EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

RISK OF CAPITAL LOSS: The portfolio does not guarantee or protect the capital invested. Capital loss occurs when a unit is sold at a lower price than that paid at the time of purchase.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

The Fund presents a risk of loss of capital.

Carmignac Sécurité AW EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Sécurité AW EUR Acc | +1.69 % | +1.12 % | +2.07 % | +0.04 % | -3.00 % | +3.57 % | +2.05 % | +0.22 % | -4.75 % | +4.06 % | +2.34 % |

| Reference Indicator | +1.83 % | +0.72 % | +0.30 % | -0.39 % | -0.29 % | +0.07 % | -0.15 % | -0.71 % | -4.82 % | +3.40 % | +0.34 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Sécurité AW EUR Acc | +0.36 % | +1.01 % | +0.71 % |

| Reference Indicator | -0.53 % | -0.48 % | -0.12 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | 1,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,11% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | There is no performance fee for this product. |

| Transaction Cost : | 0,24% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |