Funds in Focus

![[Background image] [CI] Blue sky and buildings [Background image] [CI] Blue sky and buildings](https://carmignac.imgix.net/uploads/article/0001/05/CI_WEB.jpg?auto=format%2Ccompress)

Carmignac Investissement: Letter from the Portfolio Manager

The Equity Market

The last quarter of 2020 exhibited strong and broad-based market performance.

Initially, the recovery in equities has been driven by growth stocks from the lows of March. However, in the last months of the year, value stocks rebounded sharply, both in the developed and emerging world. In fact, the news of a Covid 19 vaccine in November acted as an additional boost for markets. The names that had lagged the most in 2020, namely airlines, banks and energy companies, rallied sharply on the back of this news and reduced some of the underperformance that had occurred versus their growth stock counterparts.

Portfolio Management

Over the quarter, the Fund benefited from its wide and diversified geographic exposure. Especially, our high convictions in China recorded substantial gains, leading us to outperform our reference indicator. Also, our investment approach focusing on secular growth has continued to pay off, illustrated by our gains in the technology, healthcare and consumer space. In these sectors, we were able to generate significant alpha thanks to some of the long term thematic we focus on. These include climate change, that led us to invest in electric car companies and battery producers, notably in China. These also include companies with activities revolving around both the use and storage of big data, and many healthcare companies that are under pressure to innovate as populations age and chronic diseases increase. Finally, we added in April/May names that we felt had suffered a lot from the crisis but would benefit from steady reopening of economies. Among them, Amadeus, a Spanish IT provider for the global travel and tourism industry and Safran, a jet engine manufacturer focused on short haul tourism flights. These positions allowed us to mitigate the impact of a value catch up towards the end of the year.

Among our top contributors of the quarter, we note Chinese electric car companies, Nio and Xpeng, up respectively 139% and 177% over the period, and the biotech company Wuxi Biologics, a Chinese platform that offers end-to-end solutions to empower organizations to discover, develop, and manufacture biologics products.

Investment Outlook

2021 will be about the post-COVID economic recovery alongside continuing massive policy support. Yet markets have already adjusted very quickly to this scenario – and in some cases have become overly exuberant. Therefore, we are cautious on high valuation stocks and took profits on the key beneficiaries of the “stay at home” economy and Chinese names.

Source: Carmignac, 31/12/2020

Other: 4.7%

The portfolios of Carmignac funds may change without previous notice. The trademarks and logos are used with the authorisation of the respective entities and do not imply any affiliation with or endorsement by them.

Beyond these short-term considerations, over the long term, we believe secular growth stocks that we find in Tech and Internet, but also Health Care & Consumer, will keep performing well because of their superior growth prospects and business models. In some cases, we can even see a lot of negativity priced into the stocks – around regulation for the GAFA (Google, Amazon, Facebook and Apple) for example – that is likely to lift moving forward when visibility will increase. In addition, secular growth does not exclude cyclicality – there were many opportunities to buy COVID affected companies that combine a secular growth profile with “reopening” cyclicality – like Worldline, the European Fintech or Capital One, the US credit card issuer – both are levered to the reopening of stores and tourism. We also added Volkswagen, which has a cyclical aspect, but we believe is poised to outperform as its line of EV (Electric Vehicles) models ramps up.

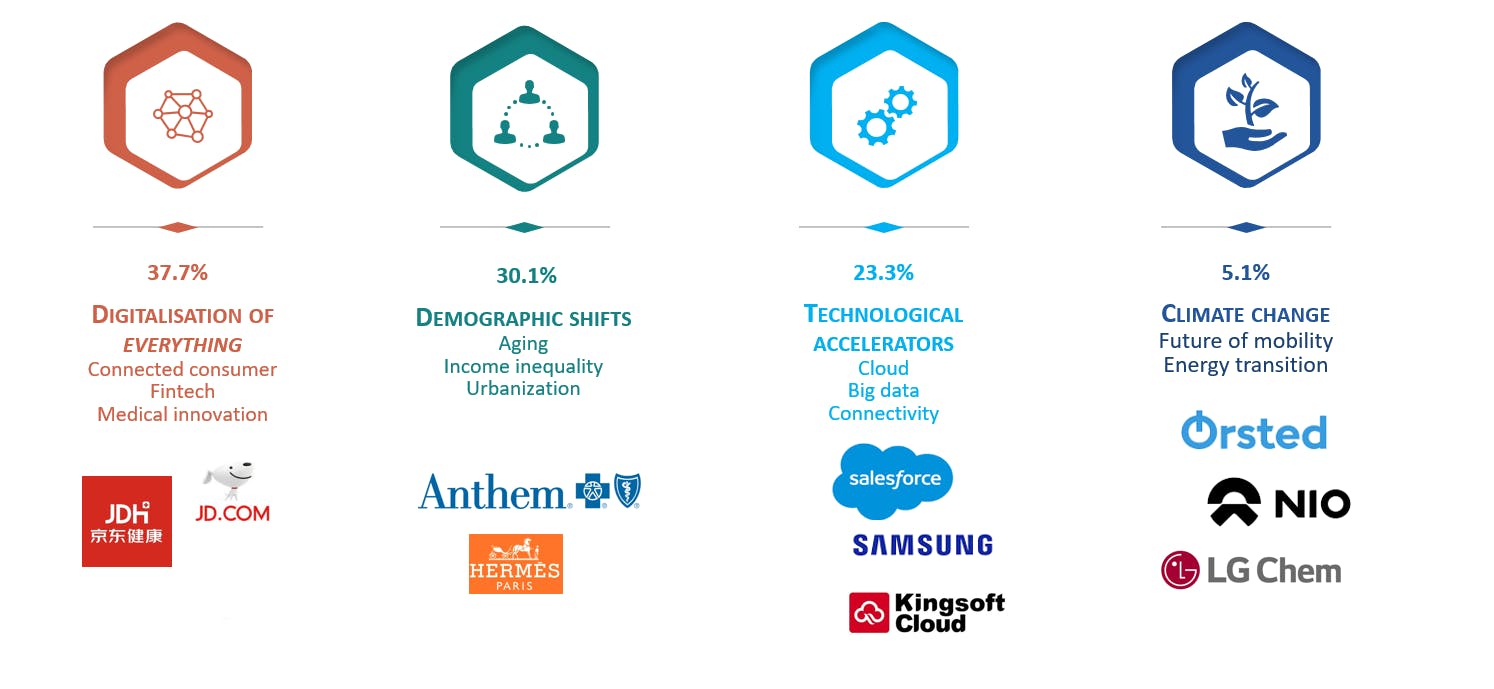

Overall, we maintain a liquid and solid portfolio of strong convictions, diversified in terms of geography, sectors and themes. Indeed, at the beginning of 2021, our main thematics revolve around:

1) digitalization (38%), with names such as the American fintech company Fiserv and the Asian e-commerce player JD.com

2) demographic shifts (30%), with names like the Danish pharmaceutical company Novo Nordisk, the American medical technology company Medtronic

3) technology accelerators (23%), with names like the Chinese company Kingsoft Cloud and the American software company Salesforce.

Finally, our constant quest for growth has led us to develop a new theme related to climate change, to participate in particular in the rise of the electric vehicle and the development of renewable energies. But we remain very selective in this thematic as investors interest has been growing very quickly leading to some very stretched valuations.

These disruptive themes have proven to be particularly resistant to a global economic downturn: many of these adoption curves have been sharply accentuated, driving up penetration rates and short-term profits. However, they continue as global economies reopen: consumers and businesses simply continue to embrace the powerful trends of e-commerce, contactless payment, and the use of the cloud, while medical advances continue.

Carmignac Investissement A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Investissement A EUR Acc | +10.39 % | +1.29 % | +2.13 % | +4.76 % | -14.17 % | +24.75 % | +33.65 % | +3.97 % | -18.33 % | +18.92 % | +21.41 % |

| Reference Indicator | +18.61 % | +8.76 % | +11.09 % | +8.89 % | -4.85 % | +28.93 % | +6.65 % | +27.54 % | -13.01 % | +18.06 % | +14.72 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Investissement A EUR Acc | +3.46 % | +11.61 % | +7.69 % |

| Reference Indicator | +9.06 % | +12.09 % | +11.12 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,50% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 1,09% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |

Part A EUR ACC code ISIN: FR0010148981 *Reference Indicator: MSCI ACWI (USD) (net dividends reinvested). Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged. Performances are net of fees (excluding possible entrance fees charged by the distributor). As of 01/01/2013, the reference indicators for the shares are calculated net dividends reinvested. Source: Carmignac, 31/12/2020 Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Carmignac Investissement E EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.