Funds in Focus

Take advantage of Emerging Markets with Carmignac Emergents

- Published

-

Length

3 minute(s) read

Five things worth knowing about Carmignac Emergents

1. Our long only, flagship Emerging Market equity fund that combines our core positioning as an Emerging Markets specialist since 1989 with our responsible investment credentials.

2. A selective, high conviction approach (50 stocks, 84% active share1) focusing on winners of the digital revolution and beneficiaries of long-term demographic trends within Emerging Markets.

3. A 5-year track record with Xavier Hovasse as lead Fund Manager, recently joined by Haiyan Li Labbé, both with more than 20 years of experience in Emerging Markets.

4. A socially responsible fund classified as Article 82 and accredited with multiple sustainability labels (French “Label ISR” in January 2019; Belgian “Towards Sustainability” in February 2020).

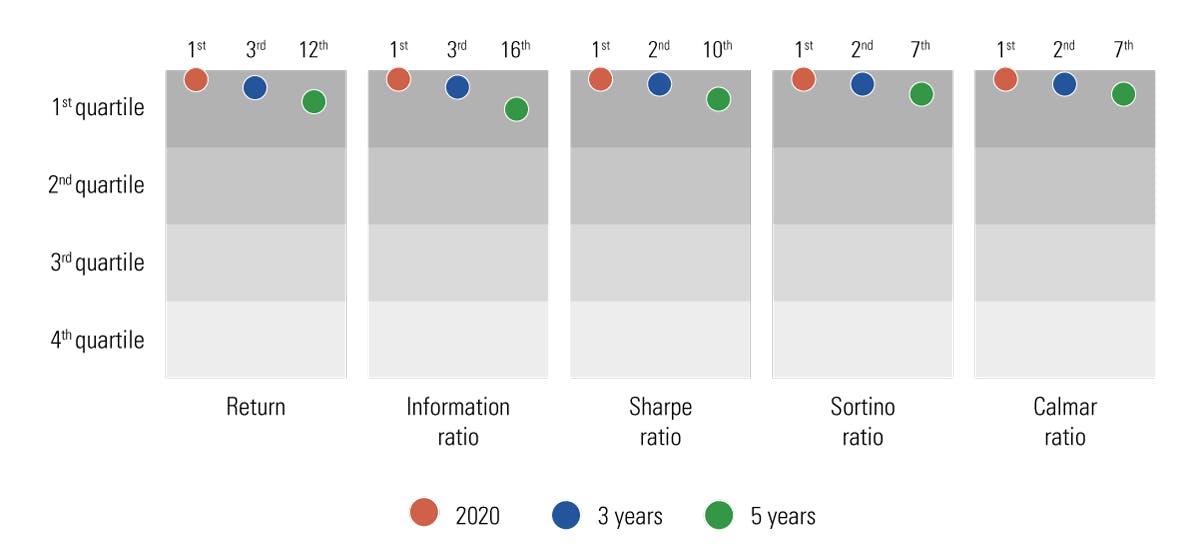

5. Good resilience in down markets, with top quartile risk-adjusted return and rankings versus its reference indicator and peers4, over 1 year, 3 years and 5 years.

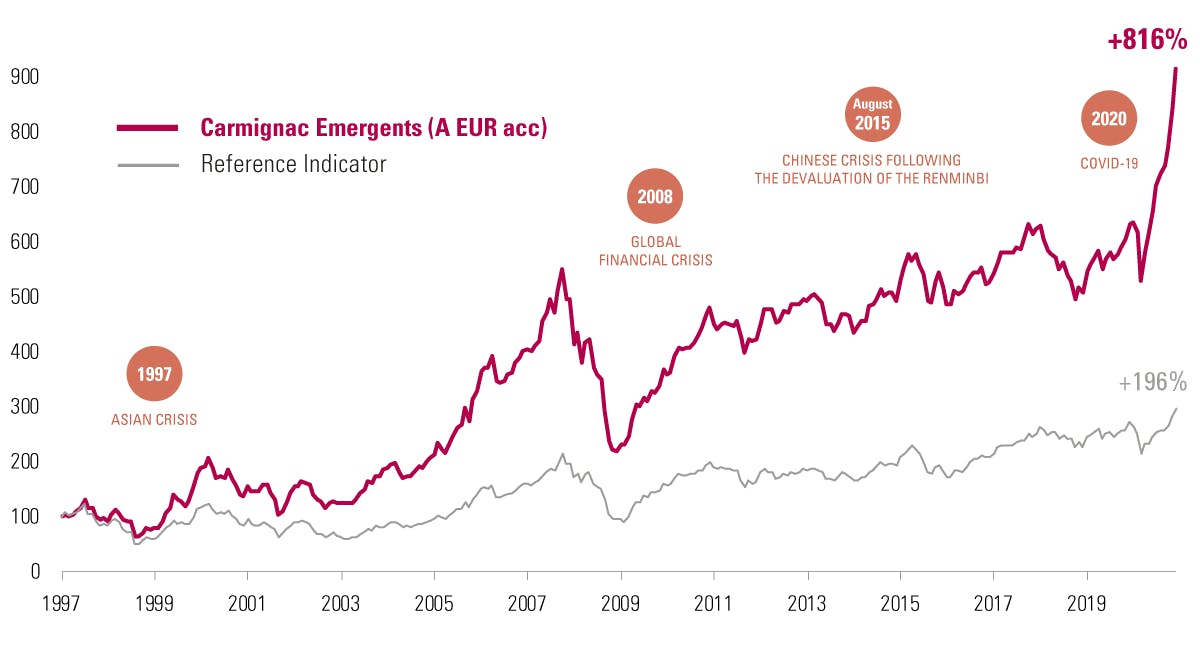

An impressive track record over the short, medium and long-term

On 3rd February 2021, Carmignac Emergents celebrated its 24th anniversary with an impressive track record and strong 2020 performance: the Fund delivered +44.7% last year, significantly outperforming its Morningstar category and its reference indicator (by 38% and 36% respectively)4.

Reference indicator: MSCI EM (EUR) reinvested net dividends. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations. Source: Carmignac, 31/12/2020.

The Fund currently ranks in the 1st quartile of its Morningstar category for its Return, Information ratio, Sharpe ratio, Sortino ratio and Calmar ratio in 2020, over 3 years and over 5 years.

Morningstar category: Global Emerging Markets Equity Source: Carmignac, Morningstar. © 2021 Morningstar, Inc - All rights reserved. 31/12/2020. Data in EUR, A EUR Acc share class. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations. Risk-free rate used: Daily capitalized EONIA. Information ratio measured against the MSCI EM NR index. Daily return used over one year, monthly for all other periods.

For more details please refer to our SRI guidelines documents, Transparency Code and Engagement Report available in the “Responsible Investment” section of our website.

1As of 26/02/2021, the Fund held 50 holdings and had an active share of 84.23%. Portfolio composition may vary over time and without previous notice.

2Classification according to the European Sustainable Finance Disclosure Regulation (SFDR)

3For more information, visit www.lelabelisr.fr/en and www.towardssustainability.be

4Reference indicator: MSCI EM (EUR) reinvested net dividends. Morningstar category: Global Emerging Market Equity.

5The Fund aims to achieve carbon emissions 30% lower than its reference indicator (MSCI EM NR USD Index).

6We target a 100% voting participation for 2021.

Carmignac Emergents A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Emergents A EUR Acc | +5.76 % | +5.15 % | +1.39 % | +18.84 % | -18.60 % | +24.73 % | +44.66 % | -10.73 % | -15.63 % | +9.51 % | +5.28 % |

| Reference Indicator | +11.38 % | -5.23 % | +14.51 % | +20.59 % | -10.27 % | +20.61 % | +8.54 % | +4.86 % | -14.85 % | +6.11 % | +10.79 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Emergents A EUR Acc | -6.30 % | +6.90 % | +5.07 % |

| Reference Indicator | -1.81 % | +4.35 % | +5.34 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,50% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 0,88% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |

Carmignac Emergents A EUR Ydis

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.