Quarterly Report

![[Background image] [CI] Blue sky and buildings [Background image] [CI] Blue sky and buildings](https://carmignac.imgix.net/uploads/article/0001/05/CI_WEB.jpg?auto=format%2Ccompress)

Carmignac Investissement Fund Update

- Published

-

Length

2 minute(s) read

A deterioration of the global economic situation

The global macroeconomic backdrop is worse today than it was at the beginning of the third quarter. Worldwide, we are seeing a decline in economic activity, as inflation erodes the purchasing power of consumers, thus depressing demand.

While the deteriorating growth outlook initially led investors to anticipate action by the authorities to revive the economy, their hopes were dashed. Central banks, led by the US Federal Reserve, have firmly stated their intention to curb inflation "whatever the cost". The only notable exception is China, which has decided to support its economy and revive growth that has been penalized by the pursuit of the "zero covid policy".

How did we fare in this context?

In this challenging backdrop, our Fund’s strategy was hurt by the underperformance of a selection of companies which, despite exhibiting solid growth and quality fundamentals, remain sensitive to a rise in interest rates. We remain convinced that this type of companies offers attractive long term perspective, rendered ever more attractive by the contraction of their valuation since the beginning of the year.

The below tab comprises of the main contributors/detractors to performance over the quarter:

-

Positive drivers to the Fund’s performance

Our selection within the industrials sector: Sunrun, an American provider of photovoltaic solar energy generation systems and battery energy storage products, recorded a decent return on the back of the Inflation Reduction Act (IRA) signed by the Biden administration that commits $369 billion to clean energy and greenhouse gas reduction.

Uber Technologies: the company reported solid Q2 earnings also contributed positively.

-

Negative drivers to the Fund’s performance

Our positions in e-commerce: particularly JD.com, a Chinese company still constrained by Covid-related health measures.

Our large position in Amazon: in the wake of a general decline in the sector, the company penalised us over the period as the company works through overcapacity in its logistics network as a result of extraordinary Covid-related demand.

Outlook

Our strategy is to build a portfolio that includes reasonably valued growth companies such as IT security for example, defensive profiles with the healthcare; commodities sectors, companies sensitive to supply/demand imbalances in the energy sector.

We start the new quarter with a very diversified portfolio in terms of sector, geography, style and bias. The core of our portfolio is made up of quality growth stocks (39%), which we balance with an allocation to the energy sector (10%) and high-growth stocks (11%), whose valuations have contracted considerably.

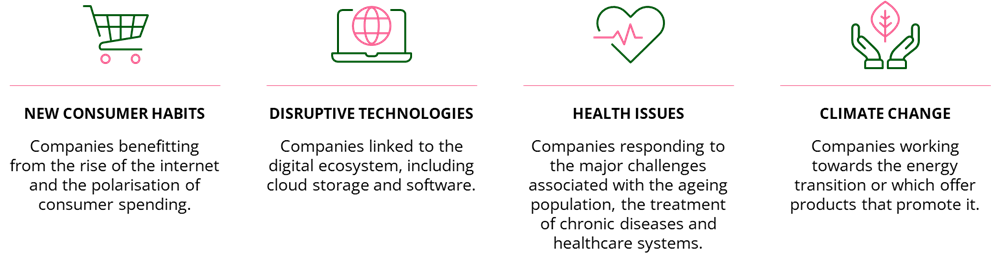

Overall, our investments continue to be supported by 4 long term secular trends, illustrated below:

A multi-thematic approach seeking to generate higher returns

Carmignac Investissement A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

Carmignac Investissement A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Investissement A EUR Acc | +10.39 % | +1.29 % | +2.13 % | +4.76 % | -14.17 % | +24.75 % | +33.65 % | +3.97 % | -18.33 % | +18.92 % | +21.41 % |

| Reference Indicator | +18.61 % | +8.76 % | +11.09 % | +8.89 % | -4.85 % | +28.93 % | +6.65 % | +27.54 % | -13.01 % | +18.06 % | +14.72 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Investissement A EUR Acc | +3.46 % | +11.61 % | +7.69 % |

| Reference Indicator | +9.06 % | +12.09 % | +11.12 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,50% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 1,09% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |