Quarterly Report

Carmignac P. EM Debt: Letter from the Fund Manager

-

+2.77%Carmignac P. EM Debt’s performance

in the 3rd quarter of 2022 for the A EUR Share class

-

+1.67%Reference indicator’s performance

in the 3rd quarter of 2022 for JP Morgan GBI – Emerging Markets Global Diversified Composite Unhedged EUR Index

-

+1.10%Of outperformance

versus the reference indicator

Carmignac P. EM Debt gained +2.77% in the third quarter of 2022, while its reference indicator (JP Morgan GBI – Emerging Markets Global Diversified Composite Unhedged EUR Index) was up +1.67%.

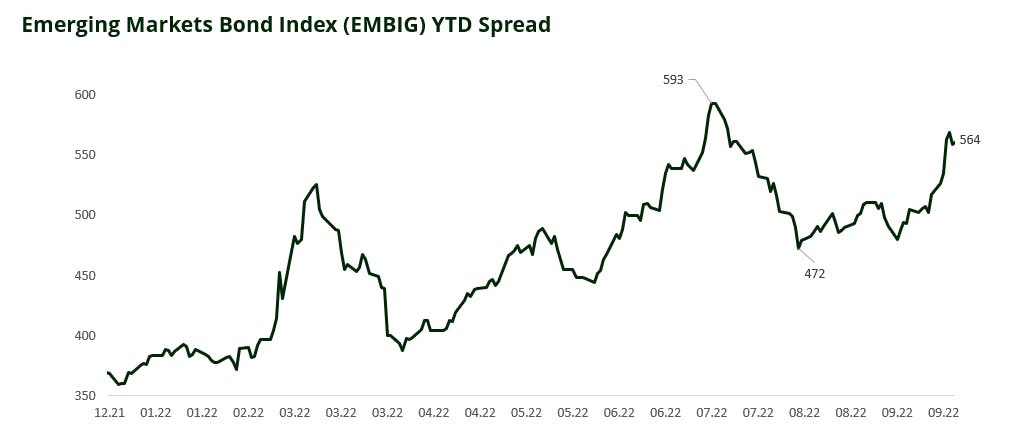

Market Environment

The last quarter was driven by a continued volatility in the developed market rates with a pull and tug between the recession risk that would force the Federal Reserve (Fed) to stop their hiking and the fight against inflation that remains persistently high. In this context emerging markets external debt has continued to trade under stress. We have seen values continue to drop in the index after a second round of volatility in US rates as the economic data was more robust than expected. The index’s spread remains at very elevated levels close to the 600 spread peaks of Covid, and over the quarter a number of credits have gone to the IMF, such as Egypt, Ghana or Sri Lanka.

Source: Carmignac, Bloomberg, 30/09/2022

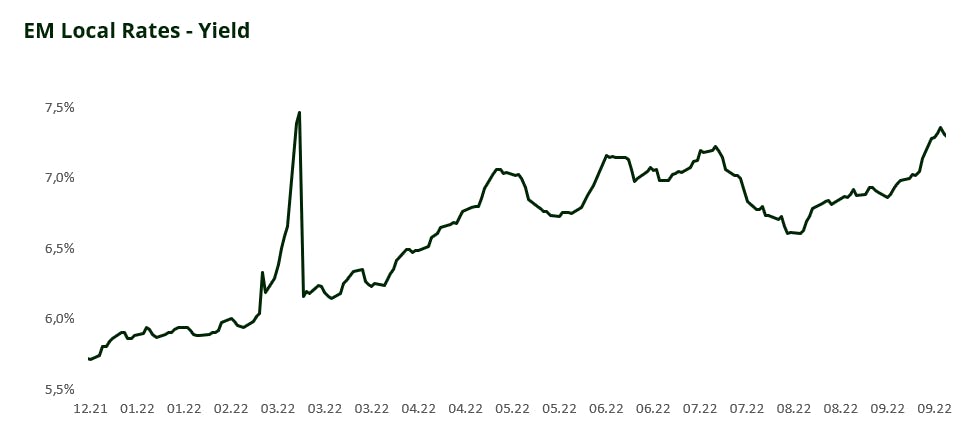

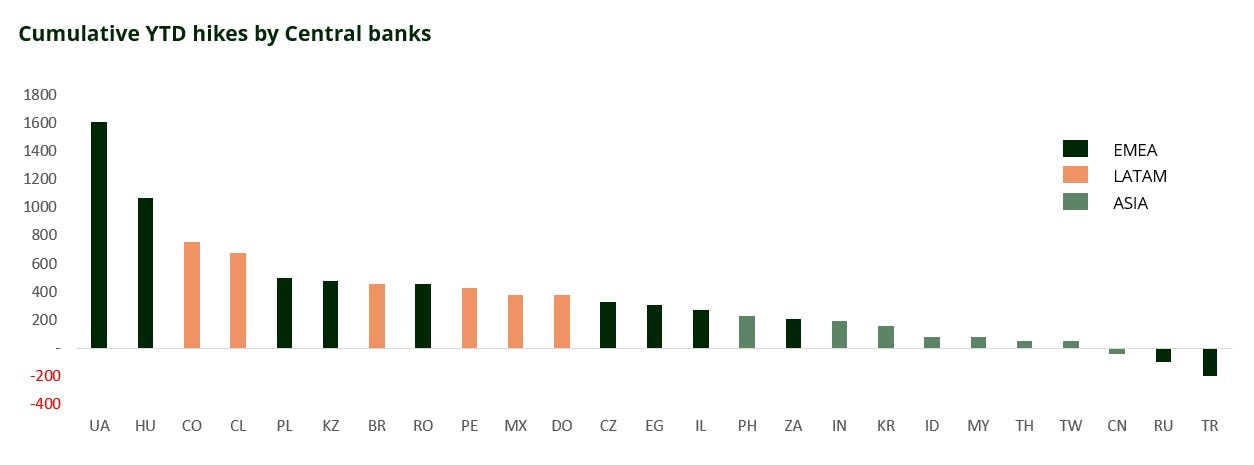

In local rates the various EM central banks have continued to tighten their policies as the inflation pressure remains as well as an increased pressure on the FX. Towards the end of this quarter however we have seen more and more central banks truly pausing their hiking cycles notably the early hikers Brazil and Czechia, but also more recently Poland and Hungary. We note that local activity indexes in EM, for consumption, or lending are showing a significant deceleration showing the impact of the tightening.

Source: Carmignac, Bloomberg, 30/09/2022

Source: Carmignac, Bloomberg, 30/09/2022

In EM FX the USD continued to strengthen during the quarter thanks to the Fed’s hawkish policy and generally risk-off sentiment. EM countries which had plentiful reserves started to defend their currencies, we can think of the INR or the CZK. In Asia we have seen an unsustainable level of reserves burn over the quarter.

What we have done in this context

In this context the fund was able to continue to generate performance of 317bps thanks largely to the FX and the Credit books.

In the external debt we managed to have a positive contribution despite the index volatility over the quarter with 352bps of positive contribution. This performance came from two sources, first the active management of our CDS protections to navigate the very volatile markets. The second source of performance was the distressed credits that we found attractive which have gone to the IMF and are making good progress on negotiations such as Egypt or Tunisia.

In rates the fund lost 209bps from positioning the fund early for a turn of EM central banks. Indeed, the pressure of the USD has forced many to continue to hike, sometime very aggressively such as the Hungarian central bank. We did put in place a payer position in India from the large buildup of imbalances and the extreme use of reserves in order while having receiver positions in countries where the central banks were pausing.

In FX we benefitted from a bias towards long USD vs Asian FX in the fund which helped generate 205bps of performance. For the Asian shorts we targeted countries which have more imbalances such as the Philippines or India. In the CE3 region we remained largely invested in FX on the long side as these countries have high rates, notably we invested in CZK and on a more tactical basis in HUF.

What is our outlook for the coming months?

Going forward we continue to see the fight between the recession in the developed world and the need to fight inflation. Furthermore, we have seen some signs of financial instability such as the large sell-off of UK rates or rumors of default at Credit Suisse that are likely to make the Fed and the ECB more cautious in their tightening policies.

For EM hard currency bonds, a slowdown of the global economy and increasing stability in developed market rates would be a very positive driver for performance. Indeed, this segment of the market has been hit very hard and many bonds continue to trade at low cash prices usually indicative of stressed credits even in quality names. EM high yield segment has reached 2008 stress levels. We intend to retain a large amount of protection in the portfolio via CDS until we see enough signs of a slowdown that it would warrant a pivot from the Fed.

In Local Rates we have started to see a pause in the rate hikes from countries and we expect this movement to continue in LATAM and EMEA. Activity in those regions is slowing down, along with consumption which will prompt the local central banks to be cautious or cut rates, on top of that the effects of higher rates in developed markets is going to help EM fight inflation. In this space we are going to continue to hold on to our payer in India, and will be long Czech, Hungarian and Brazil rates.

For the FX similarly to the Hard currency we think that signs of slowdown in the US economy will be negative for the USD and thus help EM FX perform. We retain our preference for the high carry currencies in eastern Europe but would reduce the shorts in Asia should the weak dollar be confirmed. Another factor which will be important during the quarter is the announcement of the OPEC to reduce its production of oil by 2m barrels per day. The higher oil prices, that should result, will be negative for the balances of payment of oil importers notably India or Turkey.

Carmignac Portfolio EM Debt A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

CREDIT: Credit risk is the risk that the issuer may default.

The Fund presents a risk of loss of capital.

Carmignac Portfolio EM Debt A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Portfolio EM Debt A EUR Acc | - | - | - | +0.82 % | -10.45 % | +28.07 % | +9.84 % | +3.24 % | -9.37 % | +14.30 % | +0.18 % |

| Reference Indicator | - | - | - | +0.42 % | -1.48 % | +15.56 % | -5.79 % | -1.82 % | -5.90 % | +8.89 % | +0.38 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Portfolio EM Debt A EUR Acc | +0.78 % | +6.33 % | - |

| Reference Indicator | +0.43 % | +0.15 % | - |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | 2,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,40% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% when the share class overperforms the Reference indicator during the performance period. It will be payable also in case the share class has overperformed the reference indicator but had a negative performance. Underperformance is clawed back for 5 years. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 0,57% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |